New Digital VAT Tax Refund process in Paris, France with Wevat

I have some very exciting travel news to report today! What if I told you there is a new DIGITAL VAT Tax Refund process in Paris!! If you are traveling to Paris or France in general, or plan to go to Paris in the future, you’re going to want to read and bookmark this article!

Yes, you read that correctly, I’m so excited to announce that there is a new digital way to do the VAT tax refund process. Hello, Wevat Digital tax refund process!

Today, I’m going to explain to you the new digital VAT Tax Refund process in Paris, the VAT Tax refund amount, how to qualify for VAT Tax refund, and why I’m so excited about this new process!

The best part about the new digital process, you can actually receive a higher refund amount!

But before I jump into the new digital process, let me quickly give you a quick overview of how to qualify for the VAT Tax Refund.

How to qualify for the VAT Tax Refund in France

In order to qualify for the VAT TAX refund in France, you must:

- Traditional Process: Spend 100.01 Euros or more at one given store

- Wevat Digital Refund Process: Spend 100.01 Euros total at multiple stores

- Be Over the age of 16

- You must be a Non-Eu Resident or on an EU Visa

- Be Visiting France for less than 6 months

- Must be leaving France within 3 months of purchase

Traditional VAT Tax Refund process in France

The traditional way of doing the VAT refund process, in my opinion, is a little dated. You have to carry around your passport all day with you (Which we all know isn’t the safest thing to do), and it could take months to receive your refund!

I’m so excited, there is a new digital VAT Tax refund policy that was just released called Wevat! Talk about a game changer. Plus, the new digital VAT Tax refund policy gives you a higher refund amount, and you receive it within a week!

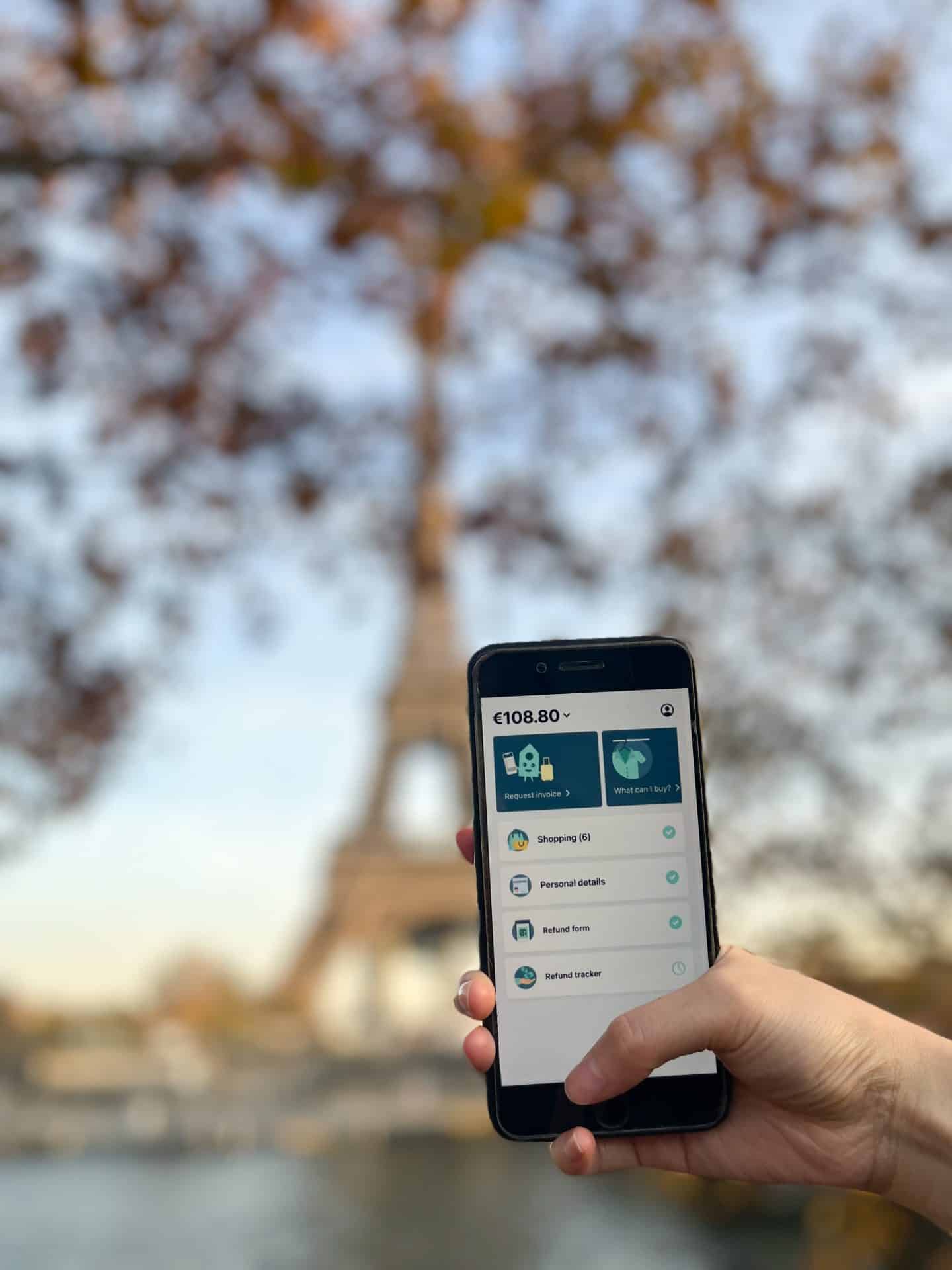

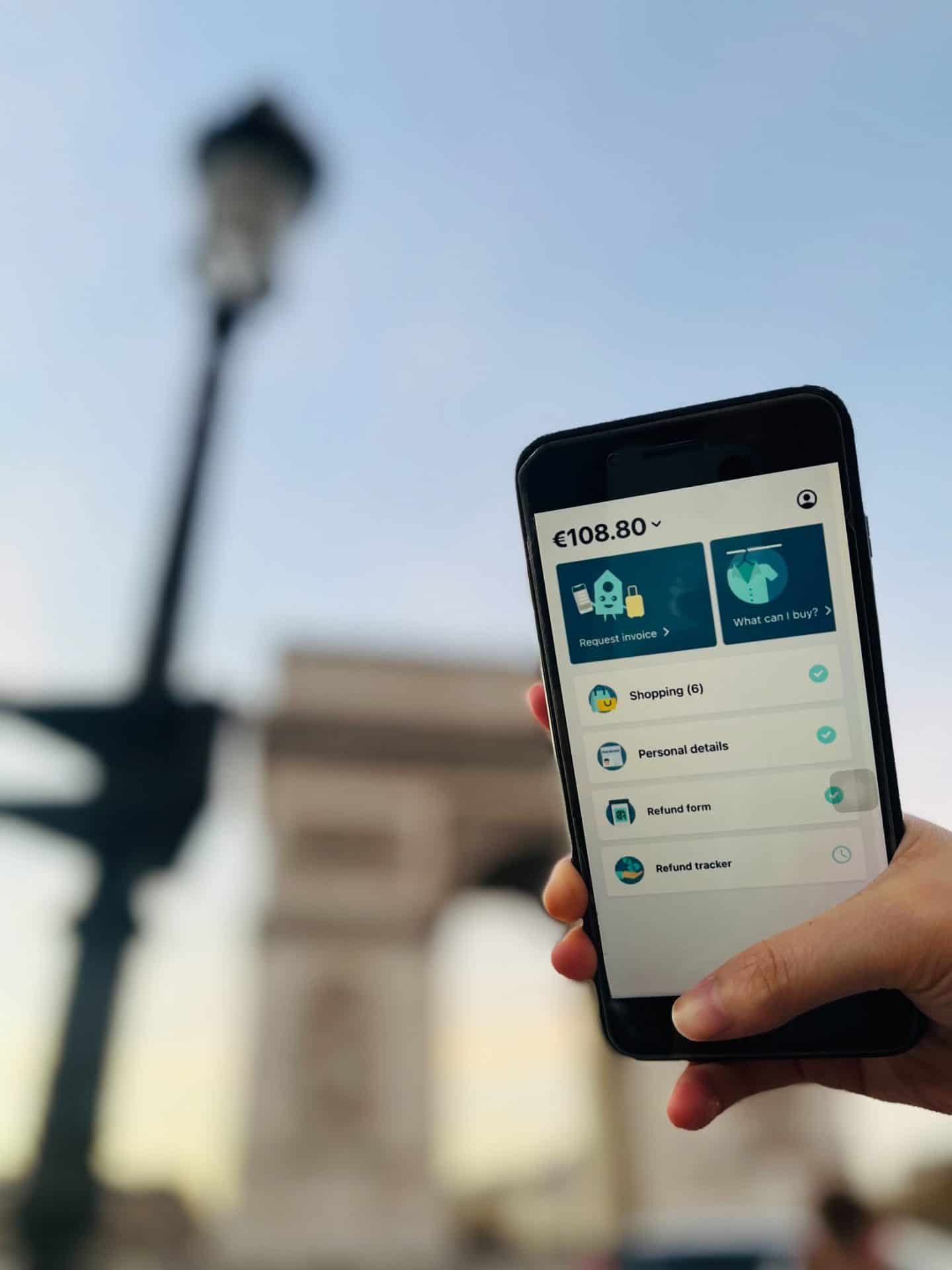

Digital VAT Tax Refund Process with the App

You may be wondering, how exactly does the digital VAT Tax Refund process work in Paris? Below is a short-detailed step-by-step guide on how to use the digital VAT Tax Refund process called Wevat. Don't forget to download the Wevat application before your trip to Paris

The app walks you through the setup process, and there is a help chat there to help you along the way if you have any questions.

Step 1. Download Wevat Tax Refund & Sign up Process

- Email, Password, Trip Date, Departing Airport

- Home Address, Confirm eligibility (over 16 years old and not an EU Citizen)

Step 2. Go Shopping (My favorite part) & Request an Invoice

- Once you are done shopping, click on the shopping tab, and it will walk you through a step-by-step process on how to request an invoice

- Request an invoice (I highly recommend saying Facture to the Sales Associate, which means invoice in French) must be addressed to Wevat.

- Show the screen that says, “Bonjour, je souhaiterais obtenir une facture au nom de:…” to the sales associate if they are confused. This has all the details needed for the invoice request in French

Step 3. Take Photo of the Invoice

- Use in-app camera phone to take a photo of the invoice

- Verify it’s addressed correctly

- In the meantime, you can verify your identity in the app, which won’t take more than 5 mins

Step 4. Generate digital refund form

- Once you have finished shopping and added all your invoices, generate a digital refund form in-app.

Step 5. Scan your form and receive your refund!

- At your departure point from the EU (Train or Plane) Scan your barcode from the Wevat App at the tax refund Kiosk detaxe machine.

In short, the new digital tax refund process in Paris is simple and takes less than 5 minutes to set up: download the app, follow the prompts, get your account set up, go shopping and then digitally upload your invoice, scan it at the departure point, and receive your refund within a week. It’s that simple.

The Best part about the digital VAT Tax Refund process is you will refund your refund within a week and receive more money back!

UPDATE * As of August 2022, the refund can take 90 days or more days to process, I will update this space when I receive more information.

How much Money do you Receive back Using the Digital VAT Refund Policy Process?

Instead of the traditional 12% VAT Tax Refund back on items in France using the pen and paper method, you received 13.4% Vat Refund back using the New Wevat Digital Tax Refund process.

For example, if you buy a Hermes bag for 5000 Euros, you will receive 670 Euros back instead of 600 Euros.

| Original Price | Traditional Process (12%) | Digital Process (13.4%) | ||

| 5,000 Euros | 600 Euros | 670 Euros | ||

| Difference | 70 Euros |

Why do you receive more VAT Tax refund using Wevat?

You may be wondering why exactly you receive more money if you file the VAT tax refund digitally. The answer is simple, you are removing the middleman in the VAT Tax refund process.

Okay, let me explain…

Traditionally, when you file the tax refund you may not realize, but you are using a B2B (Business to Business) model.

When you are using Wevat you are actually using a B2C (business to consumer) model, eliminating the commission these tax refund companies such as global blue and planet give to the stores, not to mention currency exchange companies.

Many people don’t know this, but these other tax refund (Global blue and planet) companies actually sign a contract with retailers, making it a b2b business model.

To be honest with you, before I started to do some digging and research, I had no idea that someone was making money off the refund process.

By using a B2C model, this allows you as a consumer to receive more money back!

In addition, there is a no minimum spending per purchase needed, so you can receive more money back!

Is Wevat backed by the government?

With new processes, there are always a lot of questions, and one question I anticipate receiving is the new Digital VAT Tax refund process by Wevat backed by the Government?

The short answer is yes, it’s backed by the French Government, it’s also supported by the government as well, and follows all the regulations.

For more information on that topic, you can check this out here (incorporated as vatcat, ltd)

How long does Wevat take to process a refund?

The non-digital method can take anywhere from 30-90 days. The truth is, I have had it take even longer than that. It really depends on how quickly the government and the company pay the VAT tax.

With Wevat digital VAT Tax refund process, you will receive your payment within 1 week! Don't forget to download the application! UPDATE * As of August 2022, the Wevat refund can take up to the traditional 30 – 90 days to process, I will update this space when I receive more information.

What If I require help with the while I’m shopping or when I’m doing the digital paperwork?

I completely understand being overwhelmed with the VAT Tax process in general. I’ve helped my parents, friends, and readers with the process. The truth is the traditional Vat Tax Refund process doesn’t have a lot of support, which is evident by the fact, I receive 1-3 emails a week from readers asking questions on the process and if they did something wrong.

With that being said, the Wevat Digital Tax Refund process has in-app chat support, support on their website, and even help documents in case you get stuck while going through the process.

If you get stuck or have any sort of questions regarding the app or even the process, they can definitely help you! As Always, you can certainly email me, and I’d be happy to help!

Why I’m so excited about this new Digital VAT Tax Refund process

For years, I’ve wondered why the digital VAT Tax refund didn’t exist, or why the vat tax refund policy is not digital. Well, I’m so excited to report that it is digital now! I couldn’t be more excited about the Wevat digital vat tax refund policy.

There are so many reasons I’m very excited about the new digital VAT tax refund process in Paris.

The 3 main reasons are you don’t have to carry around your passport while shopping, you receive more money back with no €100 minimum purchase, and you are refunded within a few days. Plus, the app is so easy to use!

Does Wevat work everywhere in France & How to obtain an Invoice?

You also may wonder does the Wevat tax refund app work at every retailer? The short answer will be “Yes if you get the invoice” As long as you can get an eligible invoice addressed to Wevat on the eligible goods, you can use it everywhere.

The GOOD news, it works at a majority of the popular spots such as Sephora, Galeries Lafayette, Printemps, Le Bon Marche, Hermes, AND you can even use it at the grocery store like Carrefour.

Unfortunately, based on their users’ experience, some retailers won’t provide the invoice to written out to Wevat since it means eliminating the store’s kickback and money from the government, these places include LV, Dior, and Chanel, etc.

Here are the tips for obtaining the invoice successfully when using Wevat digital VAT tax refund process :

- After you’re done shopping, ask for the facture (invoice) address to Wevat. You can show the screen in the app with all the invoice info.

They have no reason to not issue an invoice for you if you ask. But if they reject or ask for more documents to make the process very complicated, I will suggest you go for the traditional one instead.

Recap on the new Digital Vat Tax Refund Process in Paris, 2021

In short, the new Digital Vat Tax Refund process in Paris called Wevat is so easy to use: follow the app prompts to walk you through the setup process, request an invoice, use your camera phone to snap a photo of the invoice, scan the barcode within app on your way out of EU and receive your Refund within a week!! UPDATE * As of August 2022, the Wevat tax refund will take up to the 30 – 90 days to process, I will update this space when I receive more information.

Sincerely Petite in Paris,

Diane