Paris to London Vat Tax Refund Process Guide

Are you traveling from Paris to London and wondering how the VAT Tax Refund process works? You are in luck because today, I’m going to share with you a step-by-step guide on how to process your refund in Paris if you are traveling by train or plane to London. Over the years, I’ve made this trip several times and the process is simple as long as you follow these easy steps.

5-Step Guide to VAT Tax Refund Process

If you purchase any item over €100.01 in Paris, you qualify for the Vat tax refund, which a tax locals have to pay, but a tax tourist does not have to pay. The Vat Tax Refund on average is 12% of the purchase.

Step 1. Spend over €100.01 at a single store or department store

Step 2. Request the VAT Tax Refund Paperwork with a bar code

Step 3. Scan the bar code at the airport or train station

Step 4. Follow prompts on the tax refund machine (might have to drop the paperwork in the “mailbox”, show your items to the customs officer, or do nothing

Step 5. Wait 30–90 days for your refund to be process on your credit card

VAT Tax refund process Paris to London by Train at Gare du Nore

Step 1. At the EuroStar Train Station, go to the Second Floor and through security

Step 2. Locate the Self-Automated Vat Tax Machine

Step 3. Scan the bar code

Step 4. Follow the prompts on the tax refund machine (might have to drop the paperwork in the “mailbox”, show your items to the customs officer, or do nothing

Step 5. Wait 30–90 days for your refund to be process on your credit card

You must process your Vat Tax refund before you leave Gare du Nore train station and head to London in order to qualify for the refund.

VAT Tax refund process Paris to London by Plane at CDG

Step 1. Before you go through security and customs, locate the “Detaxe tax Refund” area

Step 2. Use the Self-Automated Vat Tax Machine

Step 3. Scan the bar code

Step 4. Follow the prompts on the tax refund machine (might have to drop the paperwork in the “mailbox”, show your items to the customs officer, or do nothing

Step 5. Wait 30–90 days for your refund to be process on your credit card

If you plan to process your Vat Tax refund at the airport, I recommend you leave an hour before you originally planned to in order to give yourself time to process the paperwork and wait in line. During tourist season, expect to wait in line.

VAT Tax refund process Paris to London by Plane at ORY

Step 1. Before you go through security and customs, locate the “Detaxe tax Refund” area

Step 2. Use the Self-Automated Vat Tax Machine

Step 3. Scan the bar code

Step 4. Follow the prompts on the tax refund machine (might have to drop the paperwork in the “mailbox”, show your items to the customs officer, or do nothing

Step 5. Wait 30–90 days for your refund to be process on your credit card

I found that the Vat Tax refund area at the ORY airport is less crowded that CDG. I still recommend that you arrive early and give yourself plenty of time to process the tax refund.

Do London Citizens Qualify for the Vat Tax Refund?

Yes, London Citizens qualify to receive the Vat Tax Refund. Ever since Brexit occurred, London is no longer part of the EU and their citizens now qualify to take advantage of this 12% refund the EU is offering.

Final Thoughts on Paris to London Vat Tax Refund Process

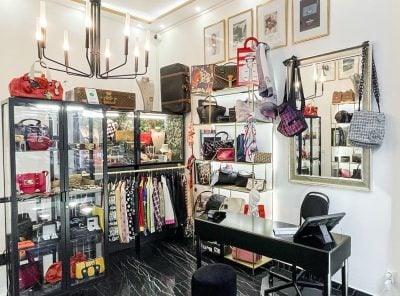

After reading this article, I hope you’re thinking, the Vat Tax refund process is simple if I’m traveling from Paris to London. Fun fact, I was recently featured in a Financial Times article talking about the price difference between luxury goods in Paris vs London. If you plan on making a big purchase, I highly recommend you to hop on a train for the day, and do all your shopping in Paris.

Sincerely Petite in Paris,

Diane