2024 VAT Tax Refund Process in Paris, France

One question that I get asked frequently is how do I process the VAT tax refund in Paris? Many people assume the tax refund process in Paris is complicated, but rest assured it’s not. As long as you follow these simple steps, you will be receiving your VAT tax refund in no time.

What is VAT Tax?

VAT Tax stands for value added tax, meaning that any goods or services that are bought or sold for consumption in the European Union is subject to VAT tax. If you spend over €100.01 at a single store or department store, you are entitled to receive the Vat Tax refund.

How much is the VAT tax Refund?

On average, you will receive a 12% refund. There are some exceptions, for example, pharmacy goods offers a 10% refund, and if you purchase food and books you will receive 5.5% refund.

Who Qualifies for the VAT Tax Refund?

- You can not be a member of the European Union (EU). Meaning you aren’t living in an EU (European Union) country, living in Europe on a visa, nor have an EU passport or an EU Resident.

- You must be 16 years of age or order

- You cannot be in a Europe Union country for more than 6 months

- At the time of your purchase, you must have your passport with you

What is the VAT tax refund process?

Simple Steps for Receiving VAT Tax Refund

- Go Shopping!

- Spend over €100.01 in a Single Store or Department Store

- Request an Invoice

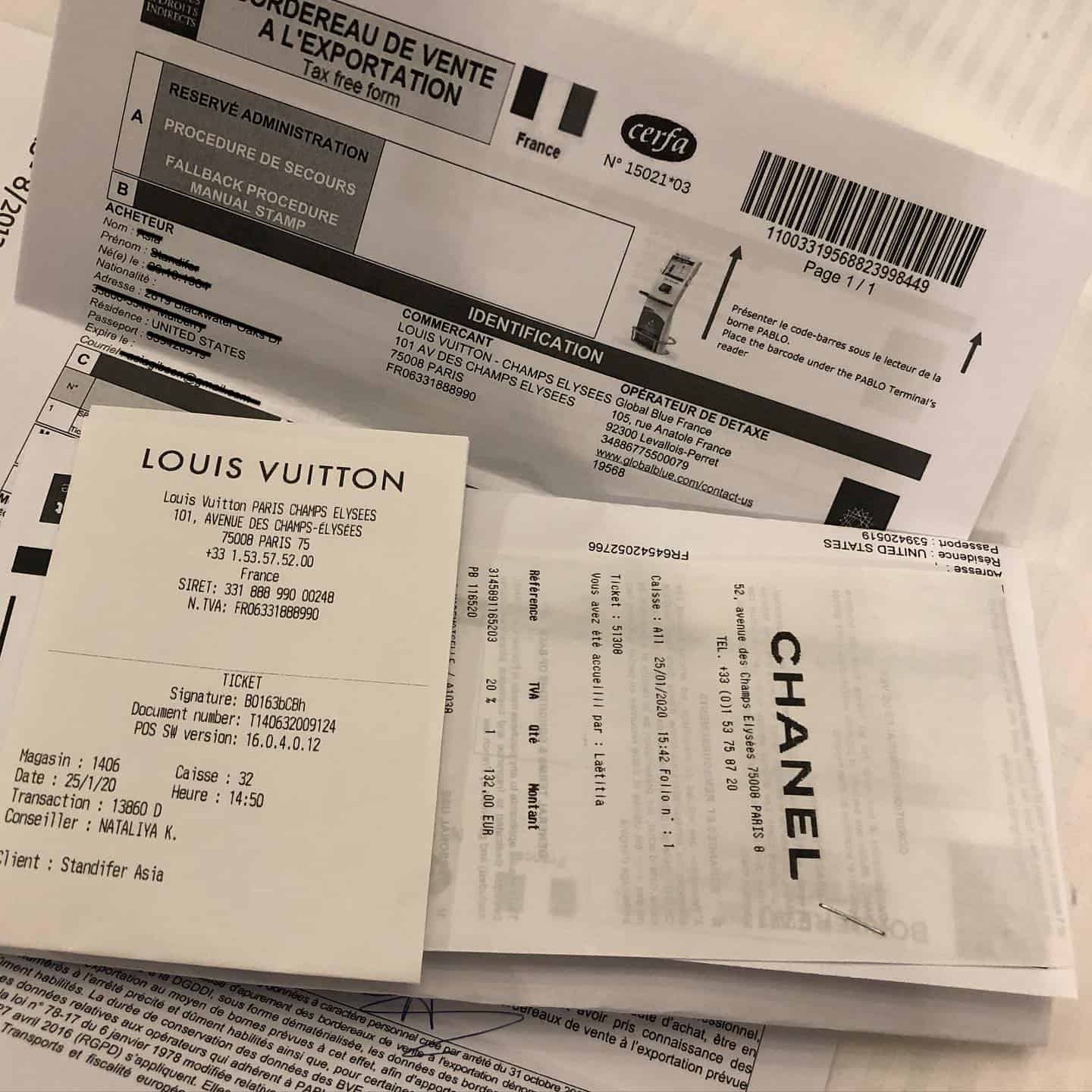

- Request a VAT Tax Refund Document

- Make sure you bring your passport

- Scan your Paperwork Before Leaving France/ EU

- Submit your tax refund paperwork at the airport or train station

- Make sure you have your purchases in your carry on for the customs officer to check (This doesn't always happen, but it can)

- Drop Form in the “Mailbox”

- Drop your tax refund form in the mailbox at the refund station

- Receive your Refund!

- Within the Next 30 – 90 days, you will receive your refund on the same credit card you purchased the item on

Using VAT TAX refund apps

Alternatively you can complete the VAT refund process digitally from your mobile phone. This allows to consolidate all your purchases from different shops into a single claim and avoid the min €100 restriction per transaction.

The French Tax and Customs Authority have recently licensed a number of VAT refund apps, such as Airvat tax refund, in order to improve the tourist VAT refund experience and also enable tax-free shopping for online purchases.

If you choose to use a VAT refund app, you don't need to show your passport at check-out but instead make sure to request an invoice addressed to your chosen refund app provider.

Can I receive a Cash Refund?

Yes, you can receive a VAT Tax cash refund immediately in stores. Typically, only department stores offer the cashback immediately option. (Printemps, Bon Marche, Galeries Lafayette, BHV, etc). With the cash refund, you will receive your cash immediately at a lower percentage of 10.8% than the standard 12%. It is extremely important that you follow the refund process and still drop your paperwork off at the airport, or else they will charge your credit card with the refund amount they provided in store.

Which European Countries Qualifies for the VAT tax refund?

These are the following European countries that qualify for the Vat Tax refund / Tax Free Shopping: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, and Sweden.

Countries that don’t qualify for the VAT tax refund: Switzerland, Norway, and the United Kingdom.

How long does it take to receive my refund after I submit my paperwork?

The Vat Tax refund on average takes 30–90 days to process. If you are traveling to Paris and go shopping during the busy season, I've seen the refunds take 6 months. If you are traveling to Paris and go shopping during the off expect, expect to receive your refund quickly.

I'm traveling to multiple different countries, where do I submit my refund?

If you are traveling to multiple countries in the EU, you will submit your Vat Tax refund at the last country you are in before leaving the EU. For example, if you are traveling to France, then Amsterdam, then Germany you would file your paperwork at the Germany airport.

Do I need to bring my passport when I go shopping, or can I have a copy of it?

One of the most popular questions I get asked regarding the tax refund process in Paris, is “do you have to carry your passport or will a copy of it work?” Yes, for the tax refund process in Europe, you have to have your actual passport. What I highly recommend is get all your shopping in one day. That way, you aren’t carrying around your passport for multiple days.

Do I need to pack my boxes for Customs if I purchase Luxury Items

No, you do not need the box to show the Customs Officer, only the object that you purchased. After you purchase your luxury items in Paris, it's important that you keep these items in your carry on or readily available to show custom officers. Many times, the customs officer will ask to see your purchase(s). Items need to be unworn.

Where do I drop off the VAT tax form at the Paris airport?

At Paris-Orly

South Terminal: Departures level, gate G

West Terminal: Arrivals level, gate E

At Paris-Charles de Gaulle

Terminal 1: CDGVAL level, hall 6

Terminal 2A: Departures level, gate 5

Terminal 2C: Departures level, gate 12

Terminal 2D: Departures level, gate 6

Terminal 2E: Departures level, gate 4

Terminal 2F: Arrivals level

Terminal 3: Departures level, airside

How Early Should I arrive to the Airport to process my Vat Tax Refund?

I highly recommend that you arrive at the airport at least an hour earlier than you were planning to process the Vat Tax Refund paperwork. Sometimes you can get lucky and there is no line, other times the line is very long.

Layovers, – Where to get your VAT TAX Stamp?

You will process the VAT refund paperwork in the country you leave from, not where the layover is.

Traveling to Multiple Countries

If you plan on visiting multiple countries while you would process the VAT TAX refund in the last EU country you are in. For example, if you are traveling to France, then Italy, then Netherlands, you will process all the VAT TAX paperwork from your shopping in France and Italy at the Netherlands airport. Make sure you get the paperwork from your shopping in France, Italy and Netherlands.

Where do I drop off the VAT tax form at the Gare du Nore train station?

When you arrive at the EuroStar train station (if you are traveling to the UK), you can claim the VAT tax refund on the second floor after you go through security. Look for the sign. It is a self-automated machine. If you cannot find the machine, then I highly recommend you ask. Make sure you do this before you leave the EU in order to receive your tax refund at the Gare du Nore train station.

What if I'm traveling to Switzerland, leaving from Gare De Lyon?

It is very important to know that if you are leaving from Gare De Lyon, there is NO “detaxe” refund machine available at the station. Instead of submitting the paperwork prior to boarding the train, you will process all your forms and paperwork while on board the train.

- The Tax Refund Paperwork happens when you are on board

- When You arrive to your destination (Geneva, Vallorbe, Lausanne or Neuchâtel) there will be a customs mailbox in the train station you drop off your VAT Tax documents you processed while on board.

- If there is not a customs officer on board your train, you can get the Tax Refund paperwork stamped and processed at the Geneva train station.

What if I forgot to submit the VAT tax refund form or did the steps wrong?

If you leave the EU and forget to submit your VAT Tax refund, there are steps you need to follow to receive your refund. Within 6 months after the date of purchase of your goods, you must send a tax refund request to the Direction Generela des Douanes et Droits Indirects, and include a copy of your passport, boarding pass, customs declaration you made for those goods when entering your country, and a letter explaining why you were not able to process the refund while you were there and the retail export form.

Direction Générale des Douanes et Droits Indirects

Fiscalité, transports et politiques fiscales communautaires (bureau F1)

11, rue des Deux Communes

93558 Montreuil

France

Recap of the European VAT Tax Refund Process

Paris is one of the most popular places in the world to go shopping with some of the most iconic brands. Remember that if you're a tourist visiting Paris, or any EU country spend over €100.01 you're entitled to the VAT Tax refund. Happy to answer any questions in the comments!

Sincerely Petite in Paris,

Diane